Study List for Quiz 1: Time Series Analysis

L1 & L2 Topics Covered:

(a) Objectives of Time Series Analysis

- Definition: Understand what is meant by time series analysis.

- Visualization: How to visualize data measured over time.

- Key Components:

- Trend: Long-term movement in data.

- Seasonality: Patterns that repeat at regular intervals.

- Cycles: Long-term oscillations without a fixed period.

- Noise: The random variation in the series.

- Forecasting: Using previous values to predict future ones.

(b) Basic EDA (Exploratory Data Analysis)

- Time series plot: Understand how to plot data over time.

- MA Smoothing (Moving Average):

- Definition of MA smoothing.

- Why and how is it used in time series analysis?

- Classical Decomposition:

- Breakdown into Trend, Seasonal, and Residual components.

- Understand how to interpret the components.

(c) ARIMA Family for Modeling Time Series Data

i. Autocovariance and Autocorrelation

- Definitions:

- Autocovariance: How two points at different times but on the same series covary as the time lag, h, changes.

- Autocorrelation: The linear dependency or correlation between two points on the same series observed at different times with time lag h.

- Importance: Why are these measurements crucial for time series analysis?

ii. (Weakly) Stationary

- Definition: Understand what it means for a time series to be (weakly) stationary.

- Expected Value Independence: �(��)E(Xt) is independent of t.

- Variance Independence: Var(��Xt) is independent of t.

- Covariance with lag h Independence: �(ℎ)=cov(��+ℎ,��)γ(h)=cov(Xt+h,Xt) is independent of t.

- Importance: Why stationary time series are easier to model and the significance of modeling stationary series first.

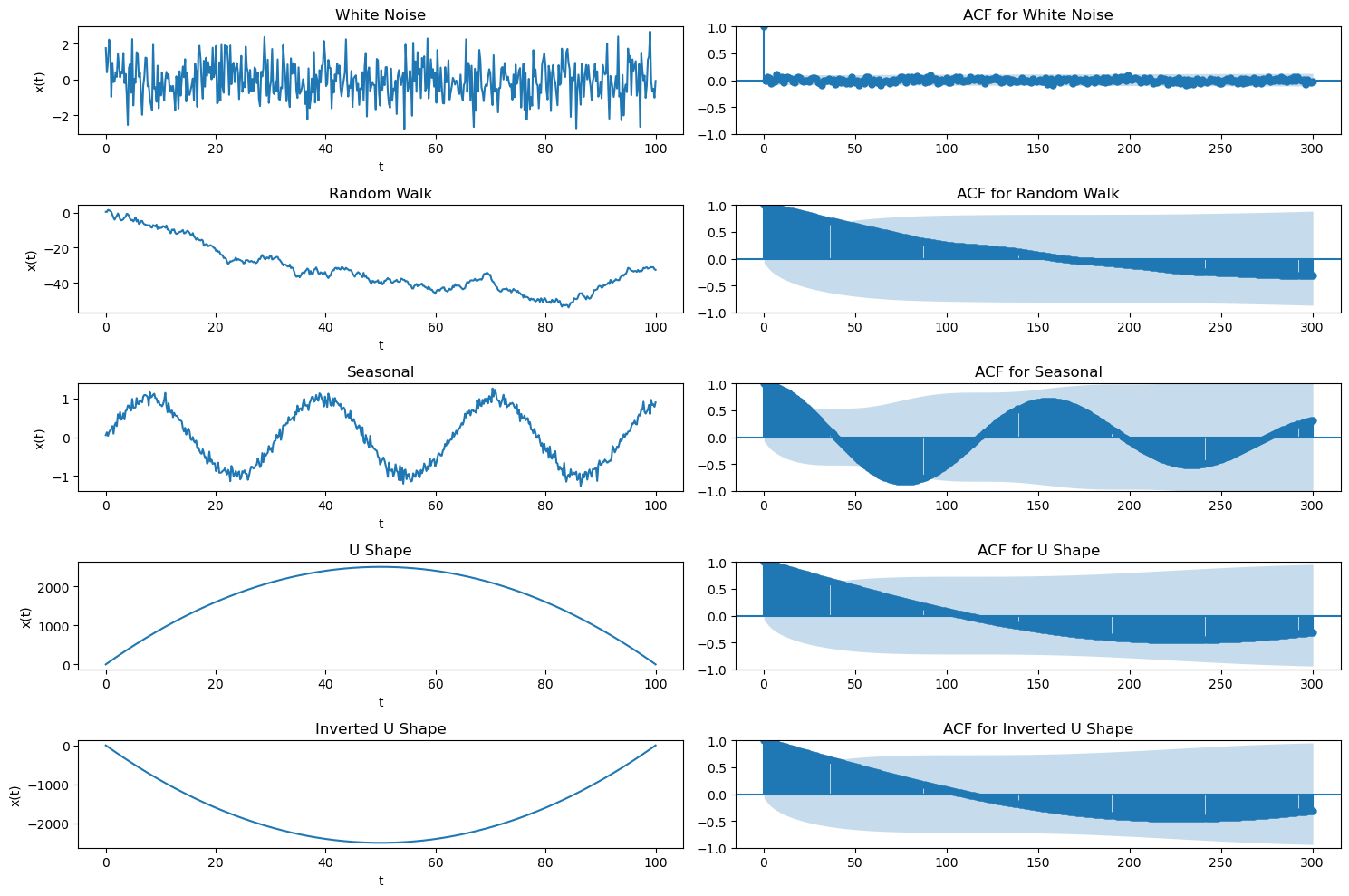

iii. Detecting Stationary Time Series

-

Time Series Plot: Using visual methods to detect stationarity.

-

Sample Estimate of ACF (ACF Plot):

- Understand how to read an ACF plot.

- Recognize patterns in ACF that suggest stationarity.

-

Test for Stationarity: ADF Test (Augmented Dickey-Fuller):

- Understand the basics of the ADF test.

- How it’s used to determine if a time series is stationary.

-

Identification:

- Be able to identify ACF plots for stationary time series.

- Recognize data with specific patterns suggesting stationarity or non-stationarity.

-

- Trend and Seasonality: Non-stationary time series often exhibit trends or seasonality. For instance, an upward trend would result in a high autocorrelation because values that are close in time would be close in value too. Similarly, if there’s a seasonality (like daily, monthly, or yearly patterns), you’d see spikes at regular intervals in the ACF plot.

-

Significance Level: It’s not just the existence of spikes in the ACF plot that matters, but whether those spikes are statistically significant. In many ACF plots, a significance boundary (often represented by horizontal dashed lines) is included. Correlations outside of these boundaries are considered statistically significant.

-

Other Indicators: While the ACF is a useful tool, it’s best used in conjunction with other tests and plots, such as the Augmented Dickey-Fuller test or the KPSS test, to test the stationarity of a time series. Additionally, the partial autocorrelation function (PACF) plot can give insights into the order of autoregression if ARIMA modeling is being considered.

- dick test:

-

- H0: The time series has a unit root (i.e., it is non-stationary).

-

- �1H1: The time series does not have a unit root (i.e., it is stationary).

- If the

ADF Statisticis less than the critical value at the 5% significance level (often it’s around -2.86, but it can vary based on sample size), and if the p-value is less than 0.05, then we would reject the null hypothesis and conclude that the series is stationary.

- dick test:

In summary, while a “wavy” ACF plot that doesn’t die out quickly suggests non-stationarity, it’s always a good idea to use multiple methods and tests to confirm your observations and decisions about a time series.